Voters are being asked to raise property taxes to fund a more competent police force and a better-funded firefighters’ retirement fund. But what about collecting some of the property taxes we currently forego?

For example, what about the roughly $7 million in free scholarships that Tulane lets state politicians dole out each year? It’s a program that dates back to the university’s earliest days and, while dogged by scandal over the years, is cited to explain why even commercial property owned by the university is largely exempt from taxation.

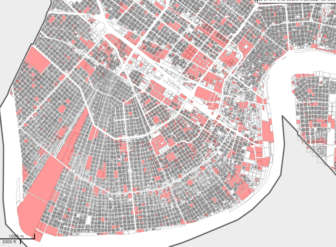

Do you know how many parcels of property in Orleans Parish aren’t taxed? As reported by the Bureau of Governmental Research in 2011, over 4,900 parcels were owed by non-profit organizations and exempt from paying property taxes. What does that mean to you? Very simply, it means this: If you own or rent a taxed parcel, you are paying more than you would if more properties were taxed. And, considering the upcoming millage vote and the rising cost of living in New Orleans, the burden on taxpayers paying more than their fair share is only getting worse.

It is my hope that Tulane will take the lead and voluntarily [make a]payment in lieu of taxes.

Since Hurricane Katrina, New Orleans has ushered in reforms to increase governmental efficiency and better deliver services, including the move to a single assessor, one sheriff and the establishment of an Office of Inspector General. What we have not seen is any meaningful property tax reform. The time to demand it is now.

Comprehensive property tax reform will require the state Legislature and the governor to allow a constitutional amendment reforming the inappropriately generous exemptions that Louisiana grants. But we can achieve meaningful local improvements toward tax equity with the voluntary participation of our private universities, starting with Tulane.

Tulane is an incredibly important part of our city’s fabric and economy, but this institution directly contributes little to the cost of providing city services. Those free scholarships doled out by each legislator and the mayor are written into arcane state laws. It can hardly be argued that scholarships given to legislators all over the state of Louisiana offset the cost of providing basic city services to Tulane’s campus and students.

It is my hope that Tulane will take the lead and voluntarily pay the city a PILOT (payment in lieu of taxes) instead of granting legislative scholarships to politicians each year. My rough calculation is that this would be a yearly PILOT of $6.8 million (149 scholarships valued at $45,758 apiece, as they were for the current academic year, according to Tulane’s website).

The 2016 legislative session is upon us. Please join me in asking your legislator and Tulane’s leadership to end this scholarship program after the 2016-17 school year. Then join with me in asking Tulane to enter into a PILOT agreement with the city starting in 2017.

Stacy Head has served on the New Orleans City Council since 2006, first representing District B, now as one of two members-at-large. Her undergraduate and law degrees are from Louisiana State University.